- #Net working capital turnover plus

- #Net working capital turnover professional

- #Net working capital turnover download

The information we need is:Ĭ u r r e n t a s s e t = 65, 377 m i l l i o n U S D \footnotesize \rm Working capital turnover ratio = 3. BABA, as listed on The New York Stock Exchange, is an online retail company that allows people to import goods from China to the rest of the world and has been experiencing incredible growth during 2020 because of the pandemic lockdown.įirst, we need to go to the 2020 Alibaba financial report. This section will explore the financial statement of one of the biggest Chinese companies: Alibaba. It can sound great because working capital turnover would indicate top efficiency however, an unexpected increase in accounts payable or a cash emergency reduction could make the company have negative working capital or non-financially insolvent. Working Capital Turnover Ratio helps determine how efficiently the company is using its working capital (current assets current liabilities) in the business and is calculated by dividing the company’s net sales during the period by the average working capital during the same period. We suggest you check the cash conversion cycle article mentioned above.īut, what if the change in working capital ends up reducing it? There we can be facing another situation where current liabilities are just covered. On the liability side, accounts payable might be decreasing because of faster payment to suppliers. Here we recommend you to also check the inventory turnover ratio calculator.Īccounts receivables might be increasing, which means the company is giving more credits to its customers. Inventory financial accounts might be increasing, which can mean less stock rotation. Your Recent History Stocks youve viewed will appear in this box, letting you easily return to quotes youve seen previously. The company should give back excess cash to investors in terms of stock buybacks or dividends.

#Net working capital turnover download

However, although an increase in cash is beneficial, too much could also be considered an opportunity cost. Download scientific diagram Actual values and predicted values of net working capital turnover ratio from publication: Anomaly Detection with Multiple. What is Working Capital Turnover The Working Capital Turnover is a ratio that compares the net sales generated by a company to its net working capital (NWC). You could verify it in the operating cash flow calculator. A change in working capital can be related directly to a change in cash. Let's check some reasons for a positive change in working capital:įoremost, we have to check cash. The answer to certain tax and accounting issues is often highly dependent on the fact situation presented and your overall financial status.An increasing working capital might sound all good however, it can reveal a few operational problems.

#Net working capital turnover plus

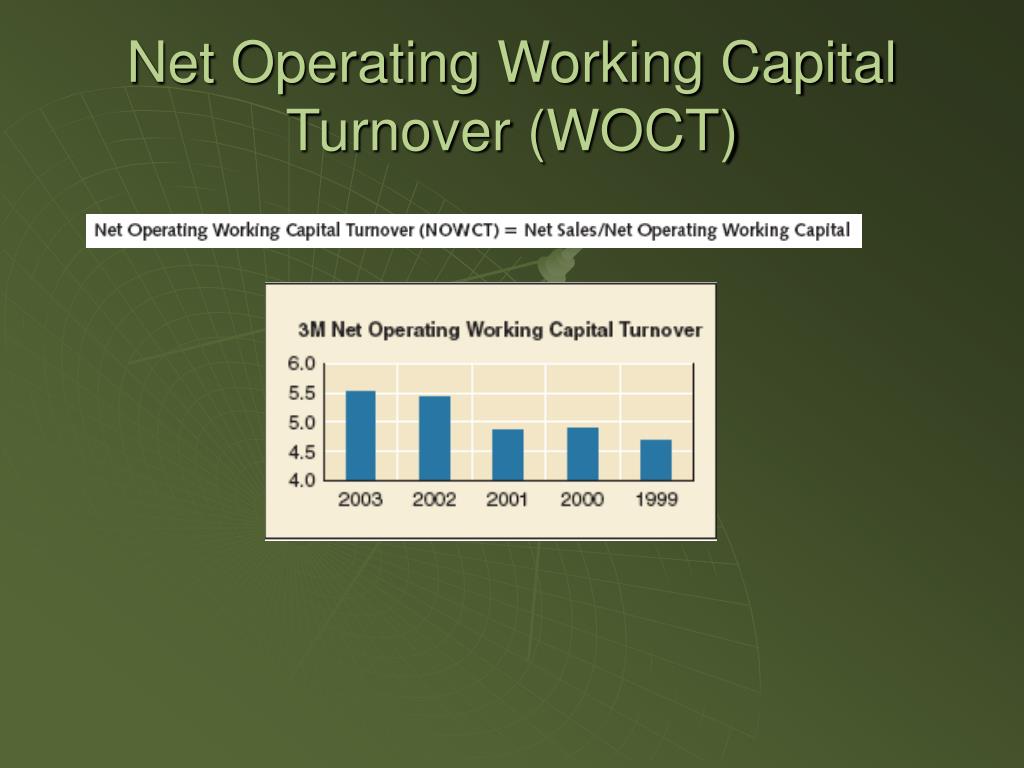

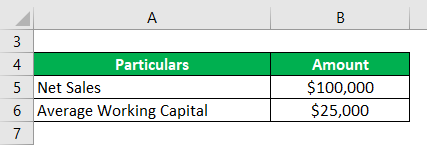

Where: Average Working Capital equals working capital at the start of a period plus working. A higher ratio indicates greater efficiency. While the concepts discussed herein are intended to help business owners understand general accounting concepts, always speak with a CPA regarding your particular financial situation. Working Capital Turnover Ratio Revenue/ Average Working Capital. The working capital turnover ratio measures how efficiently a business uses its working capital to produce sales. Therefore, the information available via this website and courses should not be considered current, complete or exhaustive, nor should you rely on such information for a particular course of conduct for an accounting or tax scenario.

Tax and accounting rules and information change regularly. Reliance on any information provided on this site or courses is solely at your own risk. Company A is using its working capital funds most efficiently, followed by.

#Net working capital turnover professional

Accounting practices, tax laws, and regulations vary from jurisdiction to jurisdiction, so speak with a local accounting professional regarding your business. Working Capital Turnover Ratio Net Sales / Average Working Capital. receivables, inventory turnover and payables with uncertainties of demand. The content is not intended as advice for a specific accounting situation or as a substitute for professional advice from a licensed CPA. level of net working capital, less capital is allocated to finance the net of. The content provided on and accompanying courses is intended for educational and informational purposes only to help business owners understand general accounting issues.

0 kommentar(er)

0 kommentar(er)